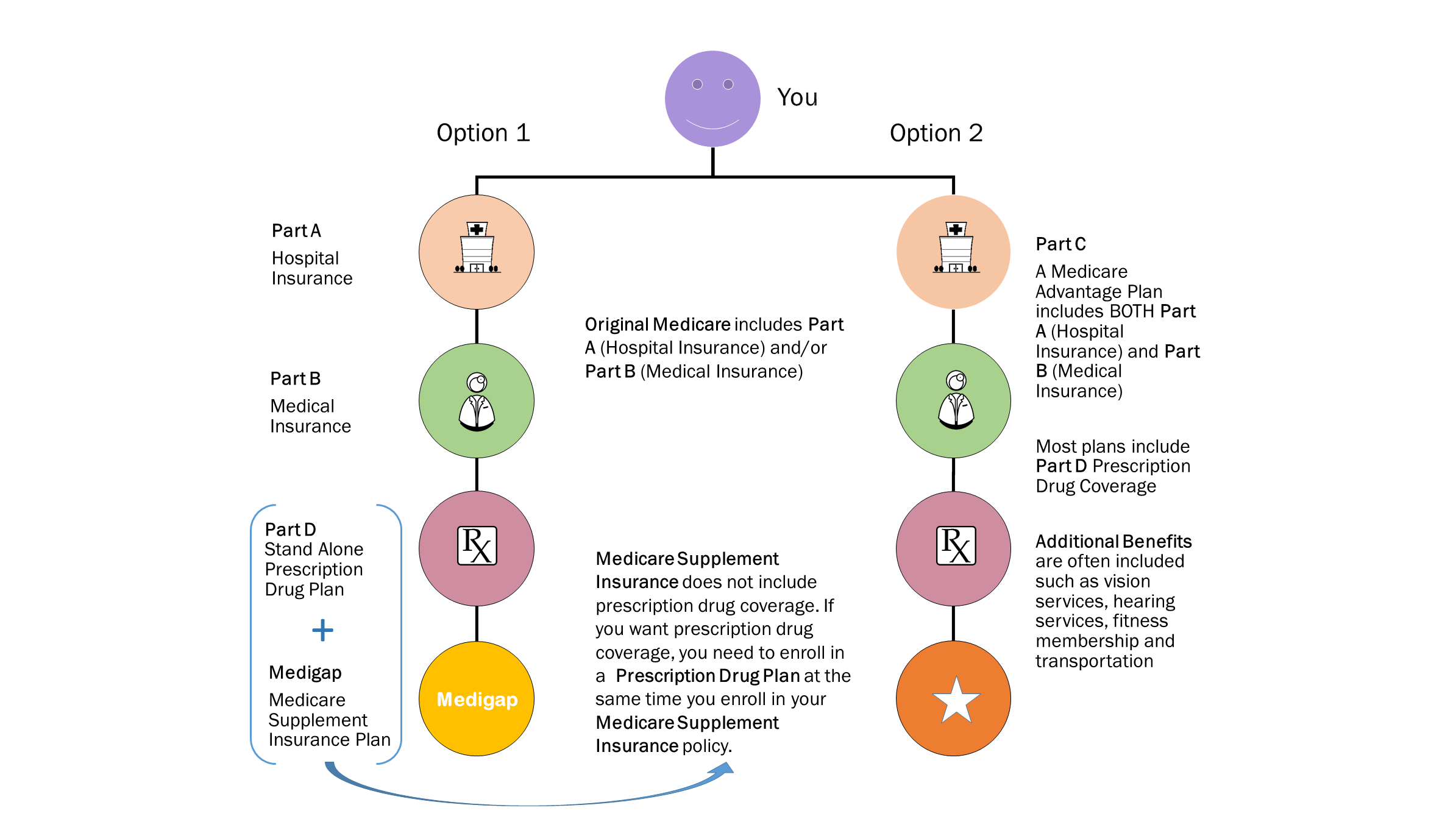

A Medicare Advantage Plan (like an HMO or PPO), sometimes called “Part C” or an “MA Plan” are offered by Medicare-approved private insurance companies that must follow the rules set by Medicare. If you join a Medicare Advantage Plan, you’ll still have Medicare but you’ll get your Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance) coverage from the Medicare Advantage Plan, not Original Medicare. You’ll generally get your services from a plan’s network of providers.

Advantages:

- Convenience of single plan

- Some include prescription drug coverage for no additional premium

- Some offer additional benefits not covered by Medicare (e.g., preventive care, vision, hearing aids, or transportation)

- If eligible for Medicare, you cannot be denied coverage

- If there is a premium, it is not affected by your age or health status

Disadvantages:

- In most plans, you receive your coverage in a service area – unless it’s an emergency

- Your access to doctors and hospitals may be limited to a specified network of local providers

- Plan premiums and terms can change from year to year

There are limited time periods for enrollment or plan changes